In a recent article in The Takeout, a website all about food, Dennis Lee wrote that he’d recently gone on a “small peanut butter and jelly kick,” which he explained usually only happens a few times a year. He shared his ideal PB&J (cheap whole wheat bread, cheap grape jelly and Skippy Natural peanut butter), and asked readers to share theirs.

He was so surprised at the response that he wrote about it a few weeks later saying “Your answers reminded me that a good old PB&J can be a really great thing, not only when you’re in a hurry, but when you’re in the mood for comfort food that’s ready to go in under a minute flat.” A lot of people are feeling good about peanut butter these days. Of course, I hear a lot about peanuts and peanut butter, and this past year I’ve heard so much about just how much people love peanut butter.

For me (I might be a bit biased) the peanut butter love is three things. (1) The PB&J is something you can count on. It’s comfortable and familiar. My favorite combination has no J – it’s peanut butter and honey with banana slices on whole wheat bread. That’s what my mom made me as kid and thinking about it feels like sunshine. It feels like home. And that’s why it’s comfort food for me. (2) Peanut butter is delicious. The sweet, salty, earthiness is the perfect trio. I could eat homemade peanut butter cookies every day and never get tired of them. (3) It’s simple and convenient. I love crunchy peanut butter on a spoon straight from the jar.

These are some of the reasons I think peanut butter has resonated with consumers over the last year. As the pandemic disrupted people’s lives and they struggled to balance working from home and taking care of their families – all under a cloud of fear and uncertainty – they turned to peanut butter as a go-to staple.

Last April, Lee Zalben, the CEO of Peanut Butter & Co., a national specialty brand, told me “The trends we’re seeing are that consumers are turning to foods that are easy to prepare and serve; have long shelf lives; are affordable and provide a feeling of comfort, familiarity and safety. Peanut butter delivers on all of these.”

As people across the U.S. began stockpiling groceries last March as stay-at-home orders went into effect, many consumers turned to familiar comfort foods like peanuts and peanut butter to stock their pantries. Independent data analyzed by the National Peanut Board showed a sizeable uptick in both peanut snack nut and peanut butter sales. March peanut butter sales were up 75% over 2019. And March peanut snack nut sales were up 24%.

Even as stay at home orders were eased, increased peanut and peanut butter consumption continued throughout 2020. The J.M. Smucker Company, makers of JIF, called peanut butter and jelly the ultimate comfort food and reported in the 52 weeks ending Nov. 1, 2020, peanut butter category consumption was up 7.1%. They attributed this growth to three primary drivers: (1) consumers are eating PB&Js as snacks; (2) Millennials and Gen X-ers are embracing PB&Js; and (3) PB&J is comfort food consumers eat to unwind.

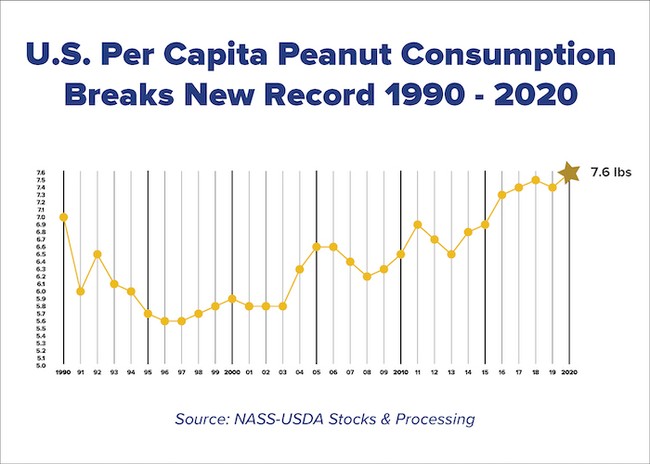

Across all categories, year-over-year usage of peanuts increased for the marketing year ending July 31, 2020[1].

This rise in consumption resulted in a record-breaking year. In 2020, consumption of peanuts (excluding peanut oil) reached an all-time high of 7.6 lbs. per capita. Aside from the affects from the pandemic, I believe product innovation is a leading factor driving this growth.

In 2008 when I joined the National Peanut Board team, peanut powder (also known as peanut flour or powdered peanut butter) wasn’t widely available. Today, you can find it in almost any grocery store. And the peanut butter aisle looks very different today, with more brands, varieties and package types to choose from. In my opinion, what’s also changed is the sheer number of products that use peanuts or peanut butter as an ingredient. Analyzing data from Mintel’s Global New Product Database on new product introductions over the last year and a few things stand out: (1) big brands delivered innovation on packaging and formulations; (2) snacks were the leading category for new products; (3) store brands came to the table with interesting and innovative offerings; and (4) there is continued growth in products with an organic claim.

Four Product Innovation Trends to Watch

Big launches from the big brands

Amid the pandemic two of the largest manufacturers of branded peanut butter announced product extensions and new products focusing on packaging innovation and new formulations. Last summer Hormel introduced Skippy protein-enriched creamy and chunky peanut butters, adding 3 grams of plant-based protein per serving. The company also introduced Skippy No Added Sugar and Squeeze Peanut Butters.

Last summer Smucker also unveiled product innovations including its own Jif No Added Sugar Peanut Butter and a new Jif Squeeze Peanut Butter. A Natural Jif Squeeze Peanut Butter was introduced earlier this year. Last year Planters introduced new Pop & Pour dry roasted and honey roasted peanuts in a recyclable plastic jar with a resealable, snap-top lid designed for on-the-go convenience.

Earlier this year the Hershey Co. brought its popular Reese’s Peanut Butter Cups into the organic space by introducing both milk and dark chocolate varieties. “We’re continuing to expand our product line so there is a Reese’s cup for nearly everyone,” said Eric Newton, Brand Manager Reese’s Organic. “When consumers go down the candy aisle or shop online, we want everyone to have an option to choose from, and we aren't settling until everyone can enjoy a Reese’s product.”

Snacks top new peanut product launches

Snacks are consistently the most active category for new peanut products. Last year KIND brought a new snack to the freezer case with its Frozen Dark Chocolate Peanut Butter Bar. It’s described as a creamy peanut butter bar, with peanuts as the main ingredient. Last summer RXBAR launched Layers Peanut Butter Chocolate Layered Protein Bar. The gluten-free snack bar is made with 3 egg whites, 29 peanuts and 1 date and provides 15 grams of protein per bar. This February Ocean Spray introduced its Craveology Spicy Coconut Curry Snack Mix made with dried cranberries, nuts (including peanuts) and coconut. It has 3 grams of protein per serving.

Store brand standouts

Store brands are active developing and launching new products with peanuts under their own labels. Last year Target, Walmart and Aldi were among the most active, according to data from Mintel. Under its Elevation brand, Aldi unveiled Peanut Butter Protein & Probiotic Mini Cookies last year, which are said to support digestive health, immune health, and protein utilization. The cookies contain 8 grams of protein per serving. Also in 2020, Trader Joe’s launched Chocolate Peanut Butter Mochi, which is described as an irresistible hand-held dessert. According to the manufacturer, the outside is a slightly chewy sweet chocolate rice dough while the inside is filled with creamy peanut butter ice cream. Earlier this year Walmart introduced its Great Value Global Voyages Pad Thai Noodles Meal Kit. The product is shelf stable and serves two people.

Organic trending up

When it comes to trending claims, organic is among the Top Growing Claims for new products with peanuts, according to Mintel data. In January, PROBAR introduced its Bite Peanut Butter Chocolate Chip Organic Snack Bar. The bar is plant-based and contains 5 grams of protein per serving. Earlier this year Noka introduced its organic Banana and Cocoa + Peanut Butter Nut Butter Smoothie. The product is described as a delicious plant-based and on-the-go smoothie that doesn’t require refrigeration and contains 8 grams of plant protein, as well as fruit and peanut butter.

Peanuts in baby food – a new frontier for food manufacturers

When people find out that I work in the peanut industry, they always ask two things. Have you ever met President Carter? Yes. And what about peanut allergy? On that front, there’s good news. First, while there’s still no cure for food allergies, in 2020 the FDA approved Palforzia the first-ever treatment for peanut allergy. Second, we now have good guidance on how to prevent peanut allergy in the first place.

Late last year the U.S. Departments of Agriculture and Health and Human Services released the 2020 Dietary Guidelines for Americans (DGAs), which for the first time provides guidance on food allergy prevention. And the guidelines specifically address peanut, “Introducing peanut-containing foods in the first year reduces the risk that an infant will develop a food allergy to peanuts.”

My colleague, Sherry Coleman Collins, a registered dietitian nutritionist and a consultant for the National Peanut Board, recently wrote about this, if you’re curious to learn more. From my perspective the new DGAs provide important momentum we need for the widespread adoption of the practice of early introduction, which was already included in guidelines from the National Institute of Allergy and Infectious Diseases (NIAID).

Widespread adoption of guidance on early introduction will hopefully lead to widespread acceptance of the practice and more and more parents will be looking for solutions to help make the task easier. Some manufacturers have recognized this and have already introduced new products. Last year Gerber came to market with Gerber Organic BabyPops Peanut, which is a puffed corn and oat snack made with peanut flour. The product is designed for babies 8 months and older. The product description states, “to help you include peanut in your baby’s diet, Gerber BabyPops are sized just right for crawlers to pick up and dissolve easily for babies learning to chew.” The brand’s website includes helpful information about the introduction of allergens. Earth’s Best Organic provides consumers with similar information on the product page for their Organic Peanut Butter Puffs.

Mission Mighty Me, recently featured by Fast Company, also makes peanut puffs. The co-founders started the company specifically to help make early introduction easier for parents. Their Proactive Peanut Puffs contain more the 50% peanuts. The main ingredients are rice flour, ground peanuts and peanut flour. They sell direct to the consumer online in cases of 5 packs. Each case is a week’s supply and contains the appropriate amount of peanut protein. One of the company’s co-founders is Dr. Gideon Lack, a pediatric allergist and researcher whose groundbreaking LEAP study resulted in new guidance on early introduction around the world.

Another recent addition to the baby food aisle is Organics Happy Baby Nutty Blends Organic Bananas with Peanut Butter baby food, which was introduced last year. The product was developed with a pediatric allergist and the label includes a statement about early introduction – “pediatric allergists recommend introducing common allergens to baby early and often.”

Take me out to the campground

As much as people love snack peanuts and peanut butter, there’s also a lot of love for in-shell ballpark peanuts. Last year with baseball in fan-less stadiums, people started wondering what would happen to the peanuts. How would it affect the farmers and suppliers? In the headline to her piece in the New York Times, correspondent Kim Severson lamented, “Ballpark Peanuts, a Classic Summer Pleasure, Have Been Benched.” In-shell peanuts ended the calendar year in 2020 up 2% year-over-year[2], but one large supplier isn’t banking on baseball for 2021.

With uncertainty about when fans can return to sporting events, Hampton Farms, the largest supplier of in-shell peanuts, is betting on a different audience this year. This spring the brand is rolling out an advertising campaign to reach campers and visitors heading to National Parks.

Jeanne Cashman, Director of Brand Marketing at Hampton Farms told me “After seeing National Parks attendance skyrocket in 2020, Hampton Farms saw the perfect opportunity to target nature lovers and show why peanuts are the new camping necessity. Peanuts are a source of protein for long days on the trail and a fun way to connect with friends and family.”

The campaign includes digital advertising, a print ad in national and state park publications and product sampling at select parks. Hampton Farms hopes the National Parks promotion will highlight new usage occasions, snacking ideas and recipes for in-shell peanuts while targeting adventurous consumers. And hopefully the campaign will help consumers make a new association for the in-shell peanuts so many associate with baseball. A different pastime, like camping, is the perfect fit for a snack like peanuts.

With peanut consumption at an all-time high, brands creating new associations for the consumer, manufacturers developing interesting and innovative new products and momentum on early introduction from the new DGAs will all help drive the incremental sales needed to continue growing peanut consumption. And while these factors are all very different, they point back to why so many of us fell in love with peanuts and peanut butter again over the last year. They meet some of our most basic needs like sustenance. They provide safety in knowing we can help prevent a baby from developing a peanut allergy. And something as simple and delicious as a PB&J can provide the comfort we need to get through challenging times.

SOURCES

[1] NASS-USDA Stocks & Processing

[2] NASS-USDA Stocks & Processing